How the Foreign Exchange System Works in Trinidad and Tobago

Trinidad and Tobago’s energy sector is the cornerstone that generates approximately 80% of the foreign exchange. However, with the sector’s finite resources paired with shifting global dynamics, its ability to sustain this provider role is nearing its end.

The Central Bank of Trinidad and Tobago (CBTT) oversees the foreign exchange market and steps in as needed to limit excessive exchange rate volatility. The CBTT’s current forex distribution strategy operates under a managed float system. Since 2017 T&T has had a de facto peg at approximately $6.78: US$1. This effectively means the government is subsidizing foreign exchange and the TT dollar is being overvalued.

What’s Causing the USD Shortage in Trinidad?

Trinidad and Tobago’s persistent USD shortage stems from its heavy reliance on energy exports, which are impacted by price fluctuations and the country’s declining production. In addition to this, the demand for foreign currency, especially from import-dependent businesses continues to outstrip supply. Also, the efforts by the Central Bank to manage reserves through controlled forex distribution have further contributed to market imbalances and access delays.

The IMF blames the current exchange rate strategy “subsidizing the currency” as the primary cause of the shortages and proposes that the U.S. dollar be floated, as the fixed rate is causing excess demand that exceeds supply.

In a Ministry of Finance (MOF) press release the then-Minister of Finance Mr. Colm Imbert (pre-election) sternly disagreed with this position. The government argues against floating the dollar to keep inflation low and, subsequently, the cost of living.

How Is the USD Shortage Affecting Citizens and Businesses?

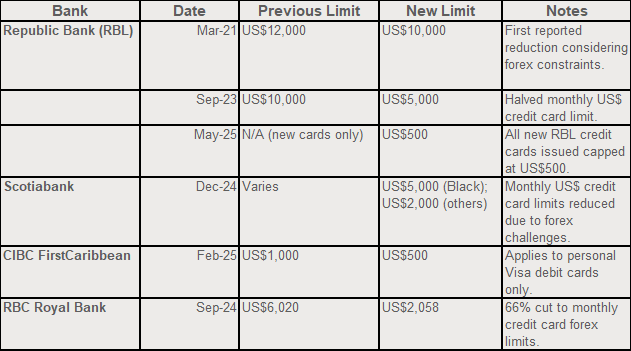

Forex availability to businesses and the public is becoming increasingly scarce. Commercial banks such as Republic Bank, Royal Bank, and Scotiabank have decreased their credit card limits. Citizens are even facing very strict limits in accessing their earned USD. These reductions continue to progress, as seen in recent trends by the banking sector. If anyone has travel plans, arrangements must be made with the bank months in advance.

Below highlights the Banking Sector USD allocation trends

This brings to the surface the issue of equality in forex distribution. Who wins and loses in the forex fight?

In a research conducted by the Chamber:

- 34.2%, one-third of respondents reported waiting over four weeks for their foreign currency requests to be fulfilled.

- 62.2% of businesses are unable to pay their suppliers on time.

- 20.7% struggle to procure essential raw materials.

- 58.2% report having to reduce their range of products or services.

The financial toll is clear, with 59.5% of businesses reporting an overall decline in profitability.

The situation is dire enough that nearly one in five businesses (19.8%) surveyed are considering relocation to regions with more stable financial systems.

A substantial 69.3% of respondents feel that unequal treatment in forex distribution particularly favoritism is a major issue. This suggests a lack of transparency and fairness in the system, which could erode public trust and lead to economic inefficiencies, as businesses with preferential access may hoard forex, creating artificial shortages for others.

What Is the Government Doing About It?

The country’s forex reserves are currently valued at 5286.60 USD million (5.29 billion USD) as of April 2025, while the Heritage and Stabilisation Fund (HSF) stands at US$6,087.9 million (6.09 billion USD) as at September 2024 since the last quarterly report.

So, if the country has forex, why can’t citizens access it?

The demand for foreign exchange continues to outstrip supply, exacerbated by the fixed exchange rate. With the government increasingly unable to meet this demand, forex must now be rationed across sectors.

Adding to the strain is the country’s high import bill, which places continuous pressure on USD reserves.

The foreign exchange shortage in Trinidad and Tobago is more than just a monetary inconvenience it’s a reflection of deeper economic vulnerabilities and policy choices. As businesses struggle to access U.S. dollars and citizens face mounting restrictions, the debate over whether to maintain the managed float or shift to a more flexible exchange rate system grows louder. Whether through increased diversification, structural reform, or greater transparency in forex allocation, meaningful change will be necessary to restore balance, rebuild trust, and secure a more stable economic future.

Sources:

Republic Bank: Credit Card Important Notice | Republic Bank

Guardian Media: Republic cuts US$ credit card limit in half – Trinidad Guardian

Stabroek News: Trinidad: Republic Bank to apply US$500 limit on new credit cards – Stabroek News

Guardian Media: Scotia cuts US$ limit on credit cards – Trinidad Guardian

Guardian Media: CIBC lowers US debit card limits in T&T – Trinidad Guardian

TT Newsday: Now RBC reduces forex limits on credit cards – Trinidad and Tobago Newsday